You miss 100 percent of the shots you never take, and if you think it’s expensive to hire a professional to do the job, wait until you hire an amateur. FOR OVER 20 YEARS, I HAVE WORKED EXTENSIVELY WITH OWNERS AND BUYERS IN LAND, COMMERCIAL AND INVESTMENT REAL ESTATE IN PHOENIX, TUCSON AND THROUGHOUT ARIZONA. PLEASE LET ME KNOW HOW I CAN HELP YOU. Call me if you want to sell your property and need an estimated value.

Phone / Prefer cell: 520-975-5207 Office: 480-948-5554 or email me walterunger@ccim.net. – What is a CCIM. In Business and in Life you don’t get what you deserve, you get what you Negotiate.

click here to view all my listings.

Walter Unger CCIM – cell: 520-975-5207 – walterunger@ccim.net

CONTACT ME IF YOU WANT ME TO GET YOU THE VALUE OF YOUR PROPERTY

Surprisingly Stubborn Inflation Joins a Downshift in Growth, Marking a Potential Risk.

By Christine Cooper and Rafael De Anda

CoStar Analytics May 1, 2024 | 7:08 AM

It didn’t take long for market optimism to fade after last week’s release of the economy’s health in the first quarter

The Commerce Department reported that the economy expanded by 1.6% (annualized and seasonally adjusted) in the first quarter over the prior three-month period, a far cry from the 2.5% that was expected. This was a significant downshift from growth from the previous quarter, which came in at 3.4%, more than twice the rate in the first quarter and even further from the third quarter of last year when the economy grew at a blistering 4.9% rate.

In reality, economic forecasters have been expecting economic growth to slow, as the Federal Reserve has been boosting interest rates and keeping them high for more than two years. That, after all, was the goal: to cool the economy and slow job growth to keep inflation from raging. But this latest data point was still a surprise given the economy’s strong momentum coming into 2024.

The headline number may have been disappointing, but the underlying details were more optimistic. Final sales to domestic purchasers, a measure that excludes the volatile trade and inventories categories and is more reflective of fundamental economic activity, also was strong, showing growth of 2.8%. Consumer spending, the most significant contributor to economic growth and generally accounting for about two-thirds of economic activity, has been robust for the past three quarters and accounted for 1.7 percentage points of the gross domestic product’s first-quarter gain.

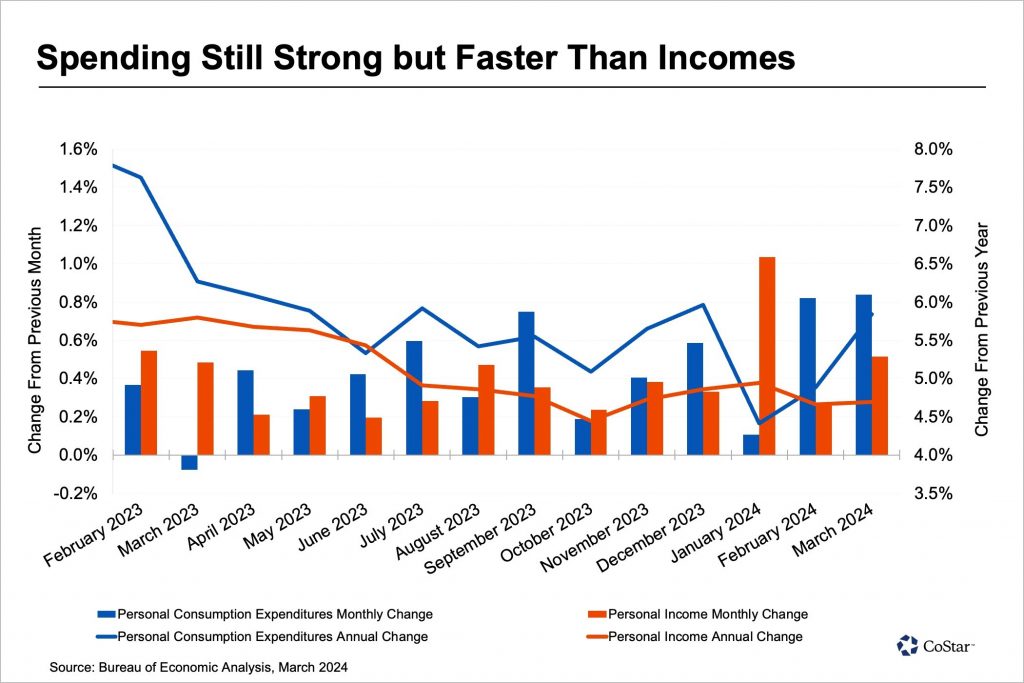

On this front, more detailed data on personal income and expenditures were released on Friday, showing that personal spending rose by 0.8% in March, similar to the gain seen in February, or by 0.5% adjusted for inflation, confirming the willingness of households to continue to open their wallets. However, personal income has not been keeping up, and households have begun relying on credit cards and personal loans to finance their purchases. More recently, rates on this credit have been rising and delinquencies are mounting.

The government’s report on economic growth also included other worrisome data. As measured by the core personal consumption expenditures price index, inflation rose over the quarter to 3.7%, also against expectations and faster than the headline rate of 3.4%. The combination of weaker economic growth and still-persistent inflation has sparked fears of stagflation.

The persistence of inflation comes as most forecasters expected inflation to slow further. Inflation of housing services, which had been easing, stalled in March at 5.8%, while core services excluding housing, the so-called “supercore” inflation, ticked higher, an unwelcome event. This has been the stickiest inflation component and has been slow to show a broad cooling trend.

| Market watchers have been lauding a “soft landing” this year and betting on the Federal Reserve to start cutting rates soon. However, with inflation still problematic, expectations have primarily moved toward a “higher for longer” regime, with many not expecting the first interest rate cut until late 2024 and a rate hike not entirely off the table. What We’re Watching … Risks of stagflation have yet to be apparent in the labor market. With the unemployment rate still near 50-year lows, claims for unemployment benefits languishing, and the economy adding an average of 250,000 jobs per month or more, we’re a long way from the economy stagnating. However, the April jobs report will be released this week, and we will be closely watching not only the number of positions added but also wage growth, as this is a significant impetus for inflation. The latest employment cost index , released this week, showed a quarterly rise of 1.2% in March, a sharper increase than expected and a sign that wage growth may be heating up. Watch out if this leads to price gains as businesses attempt to cover higher labor costs. CoStar Economy is produced weekly by Christine Cooper, managing director and chief U.S. economist, and Rafael De Anda, director of CoStar Market Analytics in Los Angeles. |

| MORE NEWS AVAILABLE ONLINE CoStar Economy is compiled by CoStar economists and delivered to your inbox each week. Let us know what else you want to see here and read more news coverage on costar.com |

Walter Unger CCIM – cell: 520-975-5207 – walterunger@ccim.net

CONTACT ME IF YOU WANT ME TO GET YOU THE VALUE OF YOUR PROPERTY

FROM ME: FOR OVER 20 YEARS, I HAVE WORKED EXTENSIVELY WITH OWNERS AND BUYERS IN LAND, COMMERCIAL AND INVESTMENT REAL ESTATE IN PHOENIX, TUCSON AND THROUGHOUT ARIZONA. Now is the time, if you are thinking of selling or purchasing your Land or Commercial Building in Phoenix, Scottsdale, Maricopa County, Pinal County, Arizona / Office / Retail / Industrial / Multi-family / please call me on my cell 520-975-5207 or e-mail me walterunger@ccim.net. Investors and Owner / Users need to really know the market today before making a move. The market has a lot of moving parts. What is going on socio-economically, what is going on demographically, what is going on with location, with competing businesses, with public policy in general — all of these things affect the quality of selling or purchasing your Commercial Properties, Commercial Investment Properties and Commercial and large tracts of Residential Land Therefore, you need a broker, a CCIM (Certified Commercial Investment Member) who is a recognized expert in the commercial and investment real estate industry and who understands your needs. I am marketing my listings on Costar, Loop-net, CCIM, CREXi, Catylist, and various other web sites. I also sold hundreds millions of dollars’ worth of Investment Properties / Owner User Properties in Retail, Office Industrial, Multi-family and Land in Arizona and therefore I am working with brokers, Investors and Developers. I am also a CCIM and through this origination ( www.ccim.com ) I have access to marketing not only in the United States, but also international

DISCOVER WHAT IS HAPPENING IN ARIZONA

History of Arizona from 900 BC – 2017 -Timeline.

click here to view all my listings.

Walter Unger CCIM – cell: 520-975-5207 – walterunger@ccim.net

CONTACT ME IF YOU WANT ME TO GET YOU THE VALUE OF YOUR PROPERTY

Walter Unger CCIM – cell: 520-975-5207 – walterunger@ccim.net

Click here to find out what is a CCIM:

CLICK HERE TO VIEW ALL MY LISTINGS.

Are you ready to sell or purchase your Land or Commercial Building in Phoenix, Scottsdale, Maricopa County and Pinal County, Arizona, please call me?

Walter Unger CCIM

Associate Broker

West USA Commercial Division

14350 N. 87th. Street, Suite 180

Scottsdale AZ, 85260

Phone: 480-948-5554

Cell: 520-975-5207

History of Arizona from 900 BC – 2017 -Timeline.

History of Arizona from 900 BC – 2017 -Timeline.

WHY PHOENIX? AMAZING!!! POPULATION IN 1950 – 350 K PEOPLE; “NOW 5 MIL”. – “5TH. BIGGEST CITY IN USA”

- DEMOGRAPHIC FACTS ABOUT MARICOPA COUNTY:

Walter Unger CCIM – walterunger@ccim.net – 1-520-975-5207 – http://walter-unger.com

Timeline of Phoenix, Arizona history

Facts of Arizona – year 1848 to 2013

CLICK HERE: Arizona Opportunity Zones As We Understand /maps. Interested!!! Please contact me.

Feel free to contact Walter regarding any of these stories, the current market, distressed commercial real estate opportunities and needs, your property or your Investment Needs for Comercial Properties in Phoenix, Tucson, Arizona.

Walter Unger CCIM

Associate Broker

West USA Commercial Division

14350 N. 87th. Street, Suite 180

Scottsdale AZ, 85260

Phone: 480-948-5554

Cell: 520-975-5207

FOR OVER 20 YEARS, I HAVE WORKED EXTENSIVELY WITH OWNERS AND BUYERS IN LAND, COMMERCIAL AND INVESTMENT REAL ESTATE IN PHOENIX, TUCSON AND THROUGHOUT ARIZONA. PLEASE LET ME KNOW HOW I CAN HELP YOU PLEASE CALL ME

CLICK HERE TO VIEW ALL MY LISTINGS.

Also Call me if you need an estimated value of your Property.

Call me if you want to see a map with what is in the Construction Pipeline for Apartments.

Prefer cell: 520-975-5207, or email me walterunger@ccim.net. CLICK HERE TO VIEW ALL MY LISTINGS.

Check out my professional profile and connect with me on LinkedIn.

Walter Unger CCIM, CCSS, CCLS

I am a successful Commercial / Investment Real Estate Broker in Arizona now for 20 years. If you have any questions about Commercial / Investment Properties in Phoenix or Commercial / Investment Properties in Arizona, I will gladly sit down with you and share my expertise and my professional opinion with you. I am also in this to make money therefore it will be a win-win situation for all of us.

Please reply by e-mail walterunger@ccim.net or call me on my cell 520-975-5207

Reasons to Consider me for Commercial Referrals

Delivering the New Standard of Excellence in Commercial Real Estate

- Commercial Real Estate Scottsdale

- Commercial Real Estate Phoenix

- Commercial Real Estate Arizona

- Commercial Investment Properties Phoenix

- Commercial Investment Properties Scottsdale

- Commercial Investment Properties Arizona

- Land Specialist Arizona

- Arizona Land Specialist

- Land Specialist Phoenix

- Phoenix Land Specialist

- Land For Sale Phoenix

- Land for sale Arizona

- Commercial Properties For Sale Phoenix

- Commercial Real Estate Sales Phoenix

- Commercial Properties Phoenix

- Commercial Properties Arizona

- Commercial Land Specialist Phoenix

- Commercial Land Phoenix

- Multifamily land Phoenix

- Retail Land Phoenix

- Industrial Land Phoenix

- Land Commercial Phoenix

- Land Retail Phoenix

- Land Industrial Phoenix

- Land Multifamily Phoenix

- Industrial Land for sale Phoenix

- Land Industrial

- P

- Investment Real Estate

Disclaimer of Liability

The information in this blog-newsletter is for general guidance only, and does not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional tax, accounting, legal, or other competent advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation. Tax articles in this e-newsletter are not intended to be used, and cannot be used by any taxpayer, for the purpose of avoiding accuracy-related penalties that may be imposed on the taxpayer. The information is provided “as is,” with no assurance or guarantee of completeness, accuracy, or timeliness of the information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.