You miss 100 percent of the shots you never take, and if you think it’s expensive to hire a professional to do the job, wait until you hire an amateur. FOR OVER 20 YEARS, I HAVE WORKED EXTENSIVELY WITH OWNERS AND BUYERS IN LAND, COMMERCIAL AND INVESTMENT REAL ESTATE IN PHOENIX, TUCSON AND THROUGHOUT ARIZONA. PLEASE LET ME KNOW HOW I CAN HELP YOU. Call me if you want to sell your property and need an estimated value. Phone / Prefer cell: 520-975-5207

Office: 480-948-5554 or email me walterunger@ccim.net. – What is a CCIM.

In Business and in Life you don’t get what you deserve, you get what you Negotiate.

contact me if you want the me to get you the value of your property.

CLICK HERE TO VIEW ALL MY LISTINGS.

Are you ready to sell or purchase your Land or Commercial Building in Phoenix, Scottsdale, Maricopa County and Pinal County, Arizona, please call me?

Walter Unger CCIM – cell: 520-975-5207 – walterunger@ccim.net

Residual land analysis is an ideal way to calculate land value based on building area, cost estimates, and development risk.

By Michael J. Rohm, CCIM, MAI | Summer 2022 CIRE Magazine

Residual land analysis is a method for determining the value of development land and is calculated by subtracting all costs associated with development from the total value of a hypothetically complete development, including profit but excluding the cost of the land. The amount left over is the residual land value — or the amount the developer can pay for the land given the assumed value of the “as complete” development, the assumed project costs, and the developer’s desired profit.

In its simplest form, residual land valuation follows this formula:

“As Complete” Value

– Cost of Development

Land Value

In other words, the land residual analysis answers the question: “What can I pay for land in order to maintain project feasibility?”

Although our attention is primarily on commercial real estate, the most understandable application of the land residual formula is with residential lots in a tract subdivision, because of the relatively small variations in the completed home values. This consistency translates into more credible “as complete” value estimates. The residual land valuation will always begin with the “as complete” value of a proposed development alternative. For instance, in the case of a tract development, a custom homebuilder will offer a buyer seemingly endless upgrades. Not all upgrades will be financially feasible. Some will be, but most will not, as the upgrades — and more importantly the combination of the upgrades — will not perfectly reflect typical market desires. These upgrades often reflect personal tastes and wants, which are rarely consistent with the typical market participant and may not always optimize the property’s resale value.

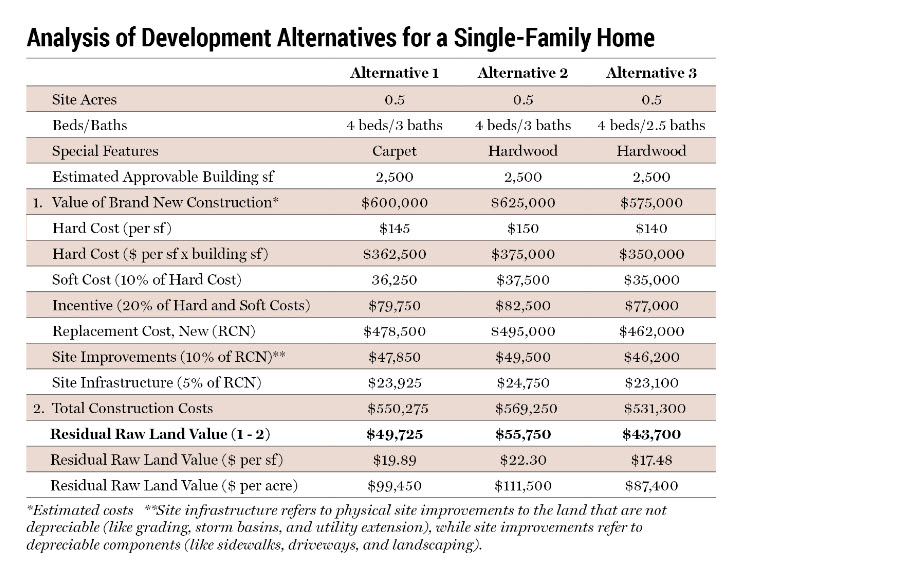

Upgrades and alternatives for custom homes are not always limited to interior modifications; they can include differences in size and exterior building materials. For our discussion, we will focus on interior alternatives to show the concept of a residual land analysis. The table (on pg. 15) shows a land residual analysis based on three development alternatives.

Alternative 1: This option is a 2,500-sf single-family home with four bedrooms and three bathrooms with carpet throughout (with the exception of the kitchen and bathrooms). This home costs $550,275 to develop and will be worth $600,000 when complete. The analysis translates into a residual land value of $49,725 ($600,000 – $550,275) for an approvable raw lot.

Alternative 2: This option is the same as Alternative 1, only with hardwood floors throughout (except for the kitchen and bathrooms). This home costs $569,250 to develop and will be worth $625,000 when complete. The analysis translates into a residual land value of $55,750 ($625,000 – $569,250) for an approvable raw lot.

Alternative 3: This option is a 2,500-sf single-family home with four bedrooms and 2.5 bathrooms with hardwood floors throughout (except for the kitchen and bathrooms). This home costs $531,300 to develop and will be worth $575,000 when complete. The analysis translates into a residual land value of $43,700 ($575,000 – $531,300) for an approvable raw lot.

As is inferred via the analysis, hardwood floors cost more than carpet and bathrooms cost more than common areas. Bathrooms and hardwood floors also contribute more value to the property, all else being equal.

Based on the residual land analysis, a four-bedroom, three-bathroom home with hardwood floors throughout (Alternative 2) is the highest and best use for the vacant site because it produces the highest residual land value. Put another way, this is the development alternative that returns the most value to the land.

One weakness in the land residual approach is the sensitivity of the analysis. This approach is limited as the value and costs are dynamic, which will be reflected over the course of the development rather than at a single point. For example, rising labor and material costs along with unforeseen expenses associated with site infrastructure could increase the final development costs, which in turn negatively impact the residual land value. This approach to analysis also does not explicitly consider holding costs and time value of money, so it is important to consider recent land sales to support the conclusion.

The weakness in relying exclusively on comparable land sales is that buyers do not always make land purchase decisions based on the real estate-related financial feasibility of proposed improvements — especially proposed build-to-suit improvements for owner-occupants or partial owner-occupants. From a commercial development perspective, owner-user decisions are often based on enhancements to business/brand value as a result of relocating, renovating, or ground-up developing in a visible or accessible location. These development decisions rarely result in real estate financial feasibility due to the location and development criteria being specific to each user. In other words, the project may be financially feasible, holistically, but it is not financially feasible from the real estate value perspective alone. This is a concept known as “transferred value,” which contends that a development may be financially feasible if one considers the enhancement to business/brand value as well (i.e. not all of the project value is derived from real estate). In this way, owner-users who develop land may employ a land residual analysis based on a combination of 1) the value of the real estate when complete, and 2) the increase in business value from having a better location and newer buildings to attract clients, thus resulting in a willingness to pay an amount for land that rarely pencils when viewed strictly from a real estate financial feasibility perspective.

Another weakness in utilizing the land sales comparison approach exclusively is that without a site survey or engineer analysis of development potential based on zoning and setback requirements, the differences in development density between sites may significantly deviate, making any comparison less credible. In short, the residual analysis is an ideal analysis if the approvable building area, estimated cost to construct, and development risk are credibly input.

Michael J. Rohm, CCIM, MAI

Michael J. Rohm, CCIM, MAI, is the founder of Commonwealth Commercial Appraisal Group & Senior Associate a Landmark Commercial Realty. Contact him at mrohm@landmarkcr.com.

FROM ME: FOR OVER 20 YEARS, I HAVE WORKED EXTENSIVELY WITH OWNERS AND BUYERS IN LAND, COMMERCIAL AND INVESTMENT REAL ESTATE IN PHOENIX, TUCSON AND THROUGHOUT ARIZONA. Now is the time, if you are thinking of selling or purchasing your Land or Commercial Building in Phoenix, Scottsdale, Maricopa County, Pinal County, Arizona / Office / Retail / Industrial / Multi-family / please call me on my cell 520-975-5207 or e-mail me walterunger@ccim.net. Investors and Owner / Users need to really know the market today before making a move. The market has a lot of moving parts. What is going on socio-economically, what is going on demographically, what is going on with location, with competing businesses, with public policy in general — all of these things affect the quality of selling or purchasing your Commercial Properties, Commercial Investment Properties and Commercial and large tracts of Residential Land Therefore, you need a broker, a CCIM (Certified Commercial Investment Member) who is a recognized expert in the commercial and investment real estate industry and who understands your needs. I am marketing my listings on Costar, Loop-net, CCIM, CREXi, Catylist, and various other web sites. I also sold hundreds millions of dollars’ worth of Investment Properties / Owner User Properties in Retail, Office Industrial, Multi-family and Land in Arizona and therefore I am working with brokers, Investors and Developers. I am also a CCIM and through this origination ( www.ccim.com ) I have access to marketing not only in the United States, but also international

DISCOVER WHAT IS HAPPENING IN ARIZONA

History of Arizona from 900 BC – 2017 -Timeline.

What is a CCIM. In Business and in Life you don’t get what you deserve, you get what you Negotiate.

contact me if you want the me to get you the value of your property.

Walter Unger CCIM – cell: 520-975-5207 – walterunger@ccim.net

Click here to find out what is a CCIM:

CLICK HERE TO VIEW ALL MY LISTINGS.

Are you ready to sell or purchase your Land or Commercial Building in Phoenix, Scottsdale, Maricopa County and Pinal County, Arizona, please call me?

DISCOVER WHAT IS HAPPENING IN ARIZONA

History of Arizona from 900 BC – 2017 -Timeline.

Walter Unger CCIM cell: 520-975-5207 walterunger@ccim.net

Walter Unger CCIM

Associate Broker

West USA Commercial Division

7077 E MARILYN RD.

Suite 200, Building 4.

Scottsdale AZ, 85254

Phone: 480-948-5554

Cell: 520-975-5207

History of Arizona from 900 BC – 2017 -Timeline.

History of Arizona from 900 BC – 2017 -Timeline.

WHY PHOENIX? AMAZING!!! POPULATION IN 1950 – 350 K PEOPLE; “NOW 5 MIL”. – “5TH. BIGGEST CITY IN USA”

Walter Unger CCIM – walterunger@ccim.net – 1-520-975-5207 – http://walter-unger.com

Timeline of Phoenix, Arizona history

Facts of Arizona – year 1848 to 2013

CLICK HERE: Arizona Opportunity Zones As We Understand /maps. Interested!!! Please contact me.

Feel free to contact Walter regarding any of these stories, the current market, distressed commercial real estate opportunities and needs, your property or your Investment Needs for Comercial Properties in Phoenix, Tucson, Arizona.

Walter Unger CCIM

Associate Broker

West USA Commercial Division

7077 E MARILYN RD.

Suite 200, Building 4.

Scottsdale AZ, 85254

Phone: 480-948-5554

Cell: 520-975-5207

FOR OVER 20 YEARS, I HAVE WORKED EXTENSIVELY WITH OWNERS AND BUYERS IN LAND, COMMERCIAL AND INVESTMENT REAL ESTATE IN PHOENIX, TUCSON AND THROUGHOUT ARIZONA. PLEASE LET ME KNOW HOW I CAN HELP YOU PLEASE CALL ME

CLICK HERE TO VIEW ALL MY LISTINGS.

Also Call me if you need an estimated value of your Property.

Call me if you want to see a map with what is in the Construction Pipeline for Apartments.

Prefer cell: 520-975-5207, or email me walterunger@ccim.net. CLICK HERE TO VIEW ALL MY LISTINGS.

Check out my professional profile and connect with me on LinkedIn.

Walter Unger CCIM, CCSS, CCLS

I am a successful Commercial / Investment Real Estate Broker in Arizona now for 20 years. If you have any questions about Commercial / Investment Properties in Phoenix or Commercial / Investment Properties in Arizona, I will gladly sit down with you and share my expertise and my professional opinion with you. I am also in this to make money therefore it will be a win-win situation for all of us.

Please reply by e-mail walterunger@ccim.net or call me on my cell 520-975-5207

Reasons to Consider me for Commercial Referrals

Delivering the New Standard of Excellence in Commercial Real Estate

- Commercial Real Estate Scottsdale

- Commercial Real Estate Phoenix

- Commercial Real Estate Arizona

- Commercial Investment Properties Phoenix

- Commercial Investment Properties Scottsdale

- Commercial Investment Properties Arizona

- Land Specialist Arizona

- Arizona Land Specialist

- Land Specialist Phoenix

- Phoenix Land Specialist

- Land For Sale Phoenix

- Land for sale Arizona

- Commercial Properties For Sale Phoenix

- Commercial Real Estate Sales Phoenix

- Commercial Properties Phoenix

- Commercial Properties Arizona

- Commercial Land Specialist Phoenix

- Commercial Land Phoenix

- Multifamily land Phoenix

- Retail Land Phoenix

- Industrial Land Phoenix

- Land Commercial Phoenix

- Land Retail Phoenix

- Land Industrial Phoenix

- Land Multifamily Phoenix

- Industrial Land for sale Phoenix

- Land Industrial

- P

- Investment Real Estate

Disclaimer of Liability

The information in this blog-newsletter is for general guidance only, and does not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional tax, accounting, legal, or other competent advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation. Tax articles in this e-newsletter are not intended to be used, and cannot be used by any taxpayer, for the purpose of avoiding accuracy-related penalties that may be imposed on the taxpayer. The information is provided “as is,” with no assurance or guarantee of completeness, accuracy, or timeliness of the information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.